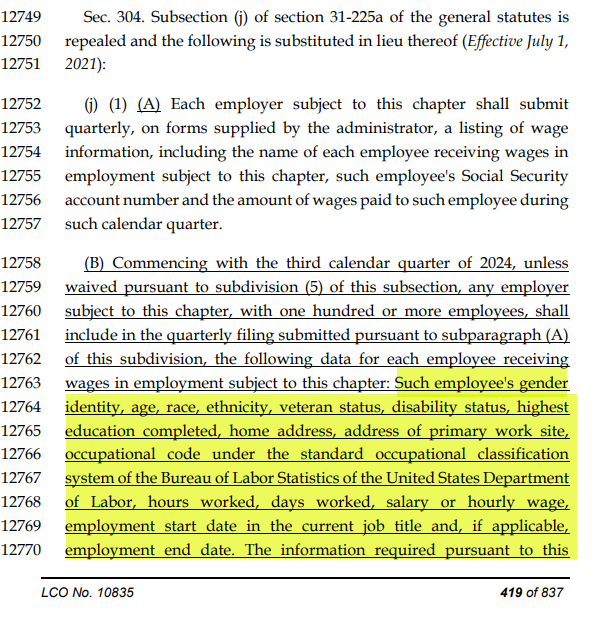

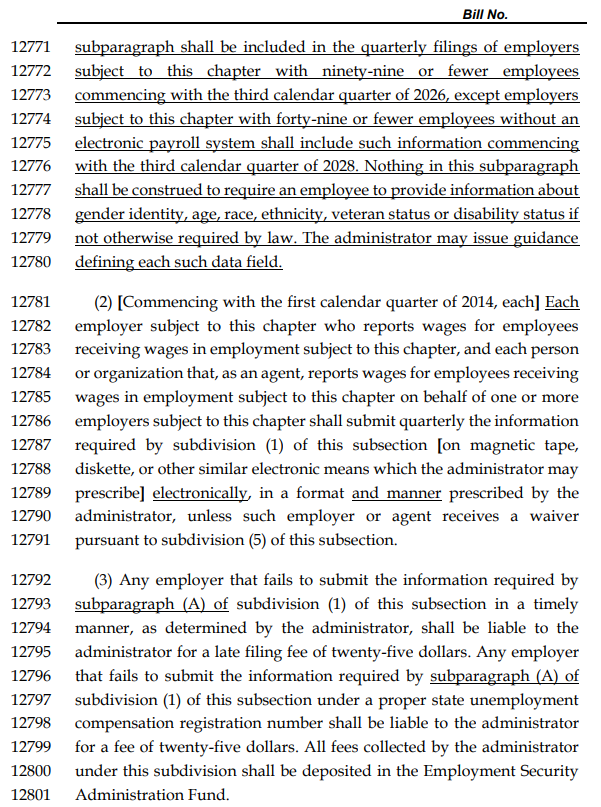

On June 23rd Connecticut Governor Ned Lamont signed SB 1202, the implementing bill companion to the state budget for the biennium ending June 30, 2023. Included in the bill was a provision that would impose a tremendous reporting burden for employers doing business in the state of Connecticut. The legislation dramatically expands the requirements for quarterly reports from name, social security number and wages paid during the quarter to a laundry list of items with no connection to the UI program, the employment security system or the Workforce Innovation and Opportunity Act. The expanded reporting requirements in Connecticut are not based on any federal requirement. The new items to be reported apply to employers with one hundred or more employees in the state. This will mean that reporting of employee information for employees in Connecticut will vastly exceed requirements in any other state. See the detail below and the summary provided.

There was very little opportunity to evaluate the administrative burden and liability issues associated with such a burdensome measure.

Will the UI federal administrative grant provide funding for the staff and systems required to gather and maintain this information?

What is the cost to employers of gathering, maintaining and reporting this information?

Must the full occupational code (SOC) be reported for every employee?

How will the SOC be determined and will it be verified somehow?

What is the retention period requirement for employers and the state?

Will the confidentiality provisions provided in Section 305 meet federal regulatory requirements?

How may individuals assure confidentiality of the information provided?

May individuals refuse to provide any of this information to employers?

What is the additional liability for employers and the state with respect to unauthorized disclosure of this information?

We are consulting with business associations, employers, the state and US DOL to raise these questions before the additional reporting requirements are fully implemented. As a practical matter, states that have implemented the reporting of SOC coding have not been able to effectively use this information for many occupations because of the complexity of the coding system and the fact that many job descriptions are not tied to SOC coding.

In addition to the usual SSN, name and quarterly wage data, the additional data includes each EE’s:

- Gender identity;

- Age;

- Race;

- Ethnicity;

- Veteran status;

- Disability status;

- Highest education completed;

- Home address;

- Address of primary work site;

- Occupational code (SOC);

- Hours worked;

- Days worked;

- Salary or hourly wage;

- Employment start date in the current job title;

- And, if applicable, employment end date.